Entrepreneurship in Greece in the times of the financial crisis

Entrepreneurship in Greece is a double edged sword, given the enduring financial crisis and associated uncertainty. One line of thinking suggests that given its financial woes, Greece will suffer entrepreneurially as talent leaves the country and investors prefer more stable destinations. An alternative line suggests that there is always opportunity coming out of the ashes and the current crisis will breed a new generation of entrepreneurs.

Both lines of thinking can be supported conceptually or empirically, and they don’t have to be mutually exclusive. At the same time, understanding entrepreneurship (in Greece but also in general) needs to go beyond the financial environment and examine other related factors that may have a material impact, given the economic backdrop.

Entrepreneurship should be enjoyable (because success is not guaranteed)

From an international point of view, the vast majority of entrepreneurial ventures do not survive past their third year of existence, regardless of the state of the economy. And for every successful app that we hear of, there are thousands of others that never make it to the publicity or profitability limelight.

Financial sustainability and long term growth require persistence, and persistence has an intuitively positive correlation with enjoyability. Greece, and indeed several other countries, offer a different entrepreneurial context, one that balances quality of life, great weather, locally produced food, and ample natural escape opportunities alongside the profit motive.

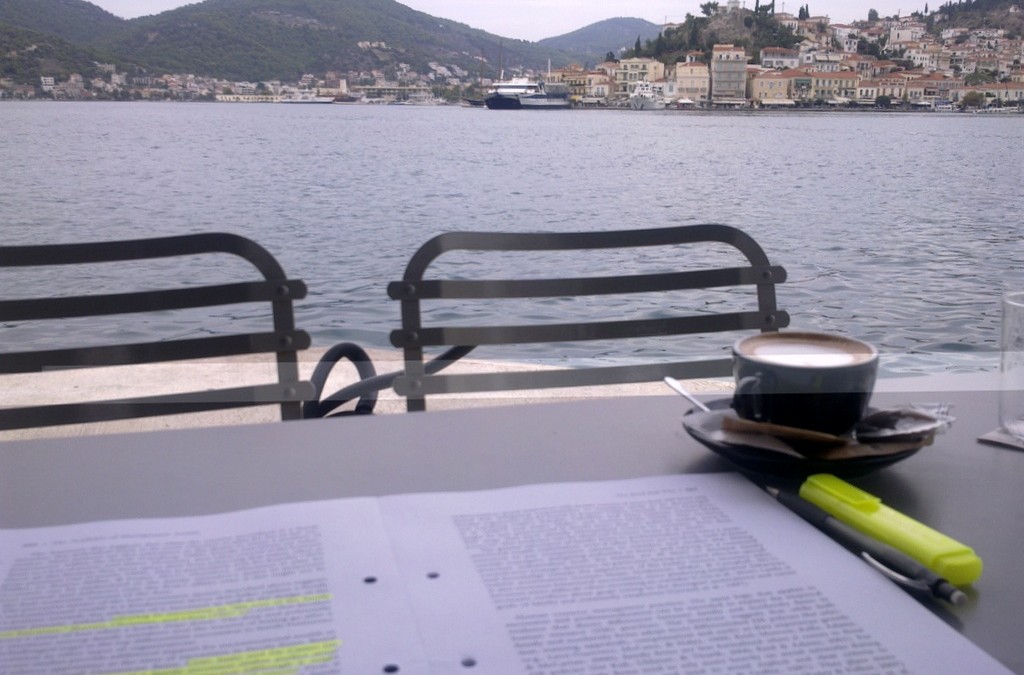

For the entrepreneur that wants to tap into deep financial markets and a large pool of programming talent, it is out of the question that places like London or San Francisco offer more opportunities, and more competition. For the entrepreneur who values combining risk taking, long working hours and stress with blue skies, healthy lifestyle, weekend breaks at nearby islands and a diverse natural ecosystem, Greece can be one of the alternatives. For me personally, it was indeed an objective of the Live-Bio venture to combine the challenges of entrepreneurship with memories that extend beyond the hours spent in pure working mode.

Greece is not only about blue skies

Having said this, entrepreneurship in Greece is not only for bon viveurs. There is a large pool of well educated graduates, relatively low labour costs and a growing ecosystem of successful entrepreneurs. Within our property at Live-Bio we are nurturing an environment that supports creativity and balances it with personal, emotional and social well being. We have already had guests who came to stay with us to study for their exams, finish writing a book, or programme code while facing the blue of the Aegean Sea.

Entrepreneurship should be enjoyable, or it will not last long. If this line of thinking appeals to you, or if it has never crossed your mind, drop me an email for an honest discussion of all the supporting and conflicting arguments that you should consider.

There are some very valid points here about the possibility and impossibility of doing business in Greece. In my opinion one of the most important reasons why one would hesitate to initiate any venture here is the constant flux of the legal and tax regulations defining a business. How can a young person, without a great amount of capital to serve as a backup can withstand the constant milking of the middle class by the tax authorities? The risk one would be called on to take seems inconsistent to the possible profits/benefits from the venture.

Hi Penelope, I could not agree with you more. I am re-posting an exchange I had with a friend who now lives in Singapore, on the very same issue of taxes.

“Taso, it is a complex question you are asking. There are two parts in the problem (plus a third one).

Τhe first is that the tax system changes constantly, depending on how much

money is missing from each year’s budget and on the (mis)calculations by

the IMF. This year, both the VAT as well as corporate tax went up.

The second problem is that, when all other countries support

entrepreneurship and small to medium enterprises, the Greek tax system

does the complete opposite. There is a flat “entrepreneurial tax”

applied to each entrepreneur without any reference to profitability. In

other words, this tax is a direct punishment for choosing to take on

risk, create jobs and economic opportunities versus getting a job

somewhere else.

The last problem is related to the first two and is the most misrepresented

one in the international media. It saddens me to hear people speaking

anecdotally, without any evidence or first hand experience, and saying

that Greeks do not pay tax. Unfortunately, Greek entrepreneurs pay tax

from the first euro of revenue, without any tax free allowance. This

constitutes one more disincentive towards entrepreneurship.

Greece’s real problem is not so much tax evasion but the lack of productive

capacity. One cannot collect more taxes from a defunct economy without

creating a dwindling spiral. Entrepreneurs could be the way out of the

spiral, but not if their business cannot make it past the first few

years (despite all the beautiful weather and good food…)

I ran a simple calculation: if one would like to live with 1000 euros a

month (which is a bit higher than the average salary to ‘compensate’ for

the risk taken), and assuming a 30% gross profit to revenue ratio, one

needs to generate sales of just under 80.000 euros in a year. If one

also accounts for the fact that a startup is also required to pre-pay

the tax for the following year, then the first year revenue would have

to be above 130.000 euros. I do not need to comment that this would be

absolutely impossible.

Now, does this cancel all the arguments I made about entrepreneurship in

Greece? In my opinion no, and this is the reason why I (and so many

others) try. Lean cost management and good financial management [clarification:

this does not imply tax management but rather the securing of adequate seed

capital, the appropriate treatment of the expected losses in the first few years

of operation and the careful investment in capital resources rather than operational

expenditure] can assist overcome some of these problems. I have already stated, if one

wants to become silly rich, Singapore, London, and Silicon Valley are

the obvious locations. Entrepreneurs in Greece look for something

different and bigger, maybe a bit masochistic given the fiscal context,

but hugely rewarding at the same time.”

The conversation is of course a lot lengthier and I would be more than happy to have it. I have had startup experiences in a number of countries and I can compare and contrast, always given my own experiences. In addition, an important dimension which I have not touched on is the type of the entrepreneurial venture, another huge discussion point, as the country now requires innovation rather than more small ‘mom and pop’ establishments.